What is an Ecommerce Payment Gateway? Why Your App Needs it?

Have you ever thought about losing ecommerce revenue due to the complicated process of checking out?

Suppose there is a consumer who is interested in purchasing from your online store but fails to do so simply because the payment procedure seems tiresome and unreliable. This is a common problem that most ecommerce companies experience, leading to loss of revenue and ending up with unhappy consumers.

What is the soulution then?

An ecommerce payment gateway is the superhero that acts as a saviour when it comes to improving your checkout process and boosting sales.

What is an Ecommerce Payment Gateway?

An ecommerce payment gateway is a critical piece of the puzzle for every website that sells online goods and services. It functions as an intermediary between your e-commerce platform and the payment processor, enabling secure transfer of payment information.

The use of ecommerce payment gateways remains important to entrepreneurs who are currently in the process of building or redesigning their online stores to enhance user experience, establish trust, and increase business.

We will explore the role of an ecommerce payment gateway and why your app needs it.

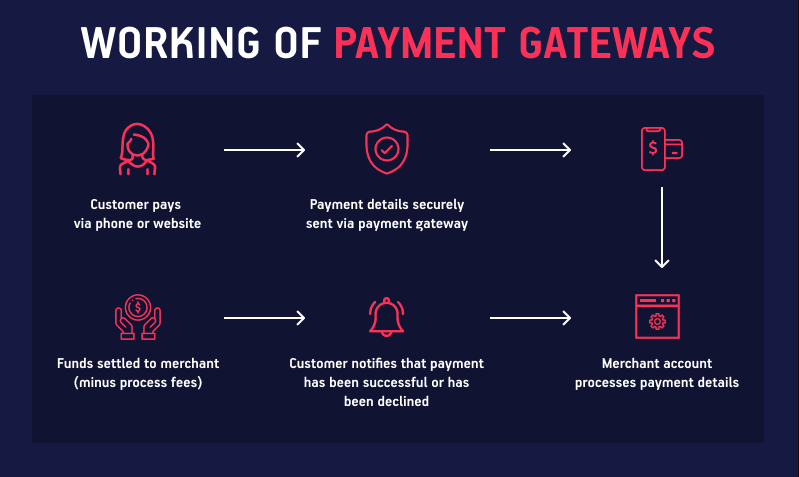

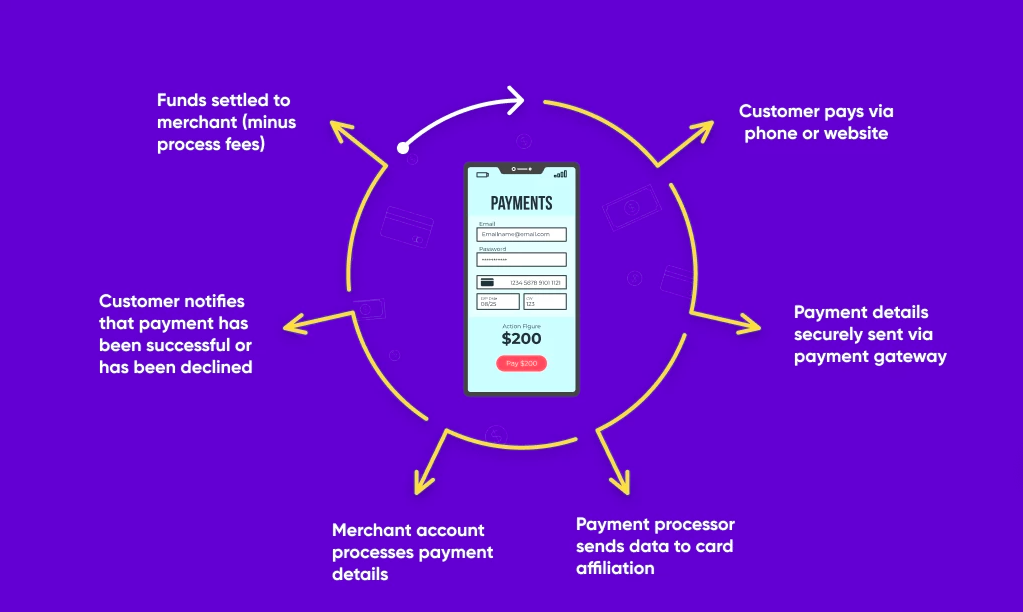

How Ecommerce Payment Gateways Enable Secure On-site Payments?

Ecommerce Payment gateway is an essential tool that empowers ecommerce businesses to process online payments effectively and safely. It will simplify the ecommerce navigation process as it assures the easiest checkout for all users.

This secure and streamlined process not only helps protect sensitive information but will also improve the customer’s overall shopping experience and can potentially increase the likelihood of purchasing from your business.

Let us discuss the steps in this process more clearly.

Customer Enters Payment Details at Checkout.

It starts when a customer makes a purchase on the e-commerce site. They input their preferred payment details, including credit card numbers, in the relevant boxes. This step must be easy to use by the users to ensure the process is completed.

Data is transmitted in a Secure Form to the Payment Gateway.

After the customer completes the order by entering the payment details, the information is encrypted and sent to the payment gateway’s processor. This secure transmission also means that sensitive customer data is protected from fraud and cyber crimes. The gateway encrypts the information to ensure that it remains secure while in transit.

The Gateway Transfers the Customer to the Payment Site

The ecommerce payment gateway will either request the customer to be redirected to a secured page for the payment process or automatically process the payment on your site.

This step is crucial in keeping the user experience consistent as in a speedy and easy transaction process people will decide to abandon the cart.

The Gateway Sends an Authorisation Request to Payment Processors.

It then sends information to the payment processor which relays the communication to the customer’s bank. The payment processor is responsible for the transfer of transaction details and asks for authorization from the bank.

The Bank Confirms the Available Funds and Authorizes the Transaction.

Lastly, the bank of the customer examines the availability of the funds and looks for any fraud. And if the bank confirms that everything is in order, the transaction is approved. This is immediately communicated back through the payment processor to the gateway.

Notification is Emailed to the Customer and the Merchant.

Lastly, the payment gateway informs the customer and the merchant that the payment transaction has been completed. The customer gets a receipt of the successful payment and can now expect their order to be processed. On the other hand, the merchant is alerted of the transaction for the fulfillment of the order.

Source: https://miro.medium.com/

On-Site vs. Hosted Gateways- Choosing the Right Fit.

It is important to define the specific characteristics of on-site and hosted gateways when you are choosing a payment gateway for your e-commerce platform. Both have their strengths and weaknesses and therefore they apply to specific businesses.

On-Site Gateways

Pros

Control and Customization

In-store checkouts provide you with full control over the process and give you the possibility to manage the design and features to suit your business perfectly. This can improve customers’ experience by increasing the efficiency of the payment process and visually integrating it into your website.

Seamless User Experience

Since all transaction processing takes place on your site, customers are not displaced to another web page, which can lower site friction and improve conversion.

Cons

Technical Expertise Required

Implementing an on-site gateway can be extremely technical. The process of setting up, as well as maintaining and securing the payment process, requires you to have the services of a competent development team.

Security Responsibilities

With more power comes more accountability. It would be entirely up to you to guarantee that the payment information is handled securely and adheres to regulations such as PCI DSS.

Hosted Gateways

Pros

Ease of Setup and Use

Hosted gateways are much easier to use and integrate with. They take care of the payment system, security, and legal issues and are especially suitable for firms with limited technical resources.

Security and Compliance

The advantage of using a payment gateway provider is that you would not be involved in the security and compliance issues related to payment transactions and hence can concentrate more on your core business.

Cons

Limited Customization

Hosted gateways usually offer standard templates and no ecommerce personalization opportunities. This can be especially difficult if you want a cohesive and branded checkout process.

Redirects

Customers are then redirected to the gateway website to finalize the transaction, which may result in increased abandonment if customers are confused or are simply apprehensive about making the payment through a third party.

Choosing the Right Fit

Considering an on-site or hosted gateway requires understanding the unique requirements of your business. I would recommend an on-site gateway if you have programming knowledge and want full control of the checkout process.

But if you do not want to hassle with installations, maintenance, and security, then a hosted gateway would be more appropriate for you. Carefully assess your company’s strengths and needs to select a payment gateway that suits your needs.

Factors to Consider when Selecting an Ecommerce Payment Gateway.

Choosing a ecommerce payment gateway is important for your e-commerce business. Below are the important aspects to bear in mind to help you identify the best funnel for your business.

Compatibility

Check to see whether the payment gateway is suitable for your business and will work with your shopping cart.

The gateway should work perfectly with the platforms you choose – whether it is popular eCommerce platforms like Shopify or WooCommerce or your self-built site. This guarantees that the work will flow seamlessly and the amount of coding required is minimal.

Integration

Determine how flexible the ecommerce payment gateway is for integration with your existing technology. Choose gateways that support rich APIs, plugins, or modules that promote seamless integration.

A gateway that can integrate with minimum technical problems will also save you time and resources which you can use in other aspects of your business.

Transaction Fees

The fee structure is an important issue. Payment gateways can also have other fees such as transaction fees, setup fees, and monthly fees. These costs should be presented in transparent and easy-to-compare formats for different gateways.

One should not forget the fact that lower transaction fees can negatively influence their income if one processes a large number of transactions as a result.

Security Measures

Security is also a concern when dealing with such sensitive payment details. Check if the ecommerce payment gateway abides by industry guidelines such as PCI-DSS and ensures data encryption is top-notch.

They protect your customers’ data and help establish confidence in your e-commerce platform as they minimize fraud and data loss.

Supported online Payments

Multiple payment methods meet different customers’ needs and may also improve their shopping experience.

Select a payment gateway that has options for various forms of payment including credit and debit cards, PayPal, Apple Pay, Google Wallet, and alternatives such as savings accounts or buy now pay later. This flexibility can result in higher conversion rates and customer satisfaction rates.

Customer Support

Timely and reliable customer support for ecommerce is crucial for resolving any problems and keeping workflow under control. The payment gateway should also provide support services such as around-the-clock availability, multiple means of communication (phone, email, live chat), and a good knowledge base.

It is advantageous to have a customer support team that can solve technical issues immediately and efficiently to avoid inconveniencing customers.

Source: https://www.netsolutions.com/

Overcoming the Challenges of Ecommerce Payment Gateways

On one hand, payment gateways have several advantages, but they also have several disadvantages. The following are some of the practical limitations and their ways of circumvention.

International Payments

International payments may be difficult due to the costs of currency conversion, different state rules and regulations, and also higher charges. Customers might leave the cart if they are experiencing issues with their chosen means of payment or when the checkout is not localized.

Solutions

- Select a payment gateway that supports multiple currencies so that the customers can make transactions in their local currency. This helps make the checkout process easier and more fun.

- Provide your payment gateway with the popular methods of localized payments used in different regions like Alipay in China or SEPA Direct Debit in Europe.

- Inform your customers of any additional fees that may be incurred for international purchases during the checkout process. Transparency in fees can create confidence and help to avoid cart abandonment.

Security Vulnerabilities

Ecommerce Payment gateways are subject to cyber threats such as data breaches and fraud. Payment security is a critical component of E-Commerce.

Solutions

- Make sure to employ a PCI-DSS payment gateway. This set of security standards aims at preventing card information theft during and after a transaction.

- Choose an ecommerce payment gateway that utilizes effective data encryption techniques to protect transaction-related information. Encryption makes sure that even if the customer data is intercepted it remains unreadable unless authorized.

- Use the fraud protection solutions offered by the payment gateway. Other features such as address verification, CVV checks, and real-time monitoring can be other forms of fraud detection and prevention.

- It is also crucial to carry out routine security audits on your payment processing systems. These audits can assist in pinpointing weaknesses and guarantee that your security strategy is current and protective against future threats.

I strongly believe that solving these issues will lead to a better payment processing system and your customers will enjoy safer transactions. Addressing the issues of international payments and security weaknesses will not only protect your business but also win the trust of your international clientele.

Benefits of Using Multiple Payment Gateways.

This is why having several ecommerce payment gateways is very beneficial for an e-commerce business. Here’s why the integration of different payment channels can work for you.

Increased Customer Convenience

Having several payment options gives you an upper hand in meeting the needs of diverse customers. Some customers prefer credit cards; others prefer digital wallets; others might prefer the bank transfer option. Offering many convenient payment methods ensures that customers are given a choice that adds to their experience.

Higher Conversion Rates

Customers have different preferences for payment methods. Supporting multiple gateways will minimize the probability of cart abandonment because the desired payment options may not be available. This can also increase the conversion rate and the number of sales.

New Security and Fraud Control.

Different ecommerce payment gateways provide different levels of security and fraud protection options. Having enough gateways is good since you can use the benefits of each provider to add security against fraud and data breaches.

Improved Reliability and Redundancy

The use of a single ecommerce payment gateway may be associated with significant risks if this gateway gets overloaded or technically compromised. The use of multiple gateways also reduces the chances of unavailable gateways that can interrupt the checkout process. You can also focus on having frictionless ecommerce checkouts to enhance the checkout experience.

Flexibility for Global Transactions

Various payment platforms are better in different parts of the world. Combining several payment gateways allows you to offer international customers more convenient and popular payment methods in their countries. This flexibility can enable you to reach many customers in various parts of the world.

Examples of Popular Ecommerce Payment Gateways.

Below are some of the leading ecommerce payment gateway providers together with their general description.

PayPal

PayPal is a well-known and trusted ecommerce payment gateway in the world market. It allows for trade in several currencies and processes credit card payments, bank transfers, and PayPal balances. Its easy-to-use interface and strong buyer protection policies make it popular with customers.

Stripe

Stripe is also recognized for its developer resources and strong API, allowing seamless integration with different e-commerce systems. It offers many alternative payment options such as credit cards, digital wallets, and local payment methods. Stripe also comes with features such as subscription billing and one-click purchasing capabilities.

Square

Square offers a smooth payment interface via its retail tools and hardware for physical payment. It supports online and offline payments and therefore, it is suitable for businesses that have both online and brick-and-mortar stores. Square also has some great business management tools such as invoicing and inventory management.

Authorize. Net

Authorize. Net is a trusted ecommerce payment gateway that provides support for several payment options. It has fraud detection, subscription billing, and a simple online terminal for credit card acceptance. Authorize. Net is also well known for its excellent customer support and wide range of integration possibilities.

Amazon Pay

Amazon Pay uses Amazon’s established customer base and brand recognition to facilitate a simple way of making payments. Customers can use Amazon accounts to shop on your site, providing a trusted checkout experience. Amazon Pay is compatible with a wide range of devices and platforms and is user-friendly.

How to Pick the Right Ecommerce Payment Gateway?

First of all, you have to define what your firm expects from a ecommerce payment gateway. Comparing the number of performed transactions, possible payment systems, merchant service geography, and special conditions.

Determine the number of transactions to be processed in a month to select a gateway that can handle these transactions. Understand which payment solutions your clients want to use like credit cards, e-wallets, and alternative payments.

Find out if you will require international payment services and multi-currency transactional capabilities. Determine whether you might need additional functionality like recurring billing, one-click purchase, or integration with specific software or networks.

Consider five or more ecommerce payment gateway providers and compare their offerings and rates. Transaction charges should also be taken seriously. They include the initial sign-up fees, the monthly fees, the per-transaction fees, and any other hidden fees.

Check if the gateway is compatible with current systems by offering APIs or plugins for easier integration. Consider the functions that are offered, from the ability to report the site, to finding fraud, and recurring payments.

Security is the most critical issue when using online payments. Check if the ecommerce payment gateway you want to choose meets PCI-DSS standards to ensure it emphasizes security.

Ensure that the gateway ensures sensitive data is protected during transactions by implementing the strongest encryption methods possible. Identify gateways with strong capabilities in fraud prevention and detection technologies.

It is crucial to effectively run the operations and address issues as they arise because of customer support. It is necessary to ask about 24/7 customer support while evaluating it. Check if there are different methods to get support including phone number, email, and live chat. Compare the average response time and the kind of help based on users’ reviews.

Visit review websites to collect feedback from other customers. To assess how frequently the gateway runs without any halts or technical hitches, focus on the reliability comment. Know how easy it is for the customer and merchant to use the gateway. Assess the effectiveness of the customer service group.

Do You Know?

Payment gateways are the secure portals that handle online transactions. But how do they fit with different ecommerce models?

- B2c vs. C2C Payments: B2B ecommerce website transactions (business-to-business) may require different payment methods or higher credit limits. Also understanding what is C2C ecommerce is important so that your gateway could be made flexible enough to handle these variations.

- Headless Hustle:

What is a headless commerce platform is something vital to get aware of as it separates your store’s front-end (what customers see) from the back-end (payment processing). Ensure your chosen gateway integrates smoothly with your headless setup for a seamless checkout experience.

Impact of a Secure Payment Gateway on Ecommerce Success.

Payment gateways provide critical support for successful e-commerce transactions by facilitating efficient checkout, establishing trust with the customer, and increasing sales opportunities through multiple payment methods.

Streamlined Checkout Process

Ecommerce Payment gateways protect credit card details during checkout and avoid cart abandonment. A fast and convenient payment process helps customers finalize their purchases for higher conversion and customer satisfaction.

Enhanced Customer Trust

Security is an essential concern for Internet buyers. When a Ecommerce payment gateway follows strict security protocols, such as PCI compliance and data encryption, it builds trust with customers that their transaction data and information are secure and convenient.

This trust results in customers coming back to the platform and referring friends and family to it for purchases.

Increased Sales Potential

It also provides multiple payment options through a secure payment gateway to meet customers’ preferences. Acceptance of credit cards and digital wallets and buy now pay later services makes your store more inclusive.

As a result, more people are likely to buy from you when you enter new markets with multi-currency and locally accepted payment methods.

The Partner for Your Ecommerce Growth.

Now that your business appreciates the importance of an ecommerce payment gateway, what next? What you want is a trusted business to work with like Appkodes, the best ecommerce app development company.

Our team expertise and mastery over tech-trends forges better understanding of your business needs, and implementing a perfect solution for your business by incorporating blockchain for ecommerce.

Our experience is all you need to evaluate your business specifications, analyze if the chosen ecommerce payment gateway suits your criteria, and come up with a perfect plan with transaction volume, payment methods, international payments in mind, and also introduce ecommerce loyalty rewards program to strengthen your customer base.

This simply means effective for processing the payments, increase in customers’ trust, and enhancing your platforms’ sales potential.

To put it in simple words, from integration to ongoing maintenance, Appkodes helps you select the most appropriate ecommerce payment gateway solution for your e-commerce platform.

Elevate your business to the next level with Appkodes.